*The Economic Insights report is a snapshot of a broader in-depth research report created for private sector companies. The overall theoretical methodology behind the report can be found at the following link, The Problem of Big Data: An A Priori Epistemelogical Approach to Technological Advancement. For the full report or questions regarding methodology please go to contact me.

Economic Overview

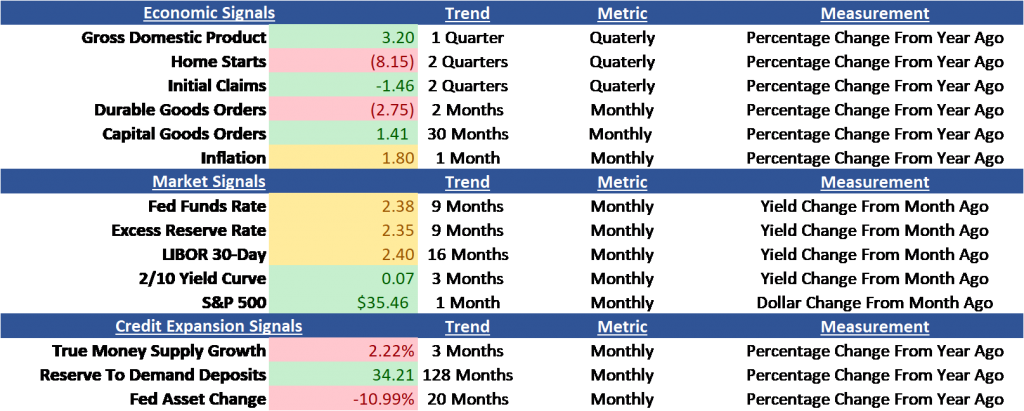

The second quarter brought mixed signals and continued volatility to the market causing confusion about the real future trajectory of the economy. These mixed results are being driven by the underlying economic activity and the polarizing political landscape. It is important to keep in mind that the political rhetoric can influence short term change but can’t change the underlying economic reality long term. Thus, it’s important to focus on the true state of economic activity and stages of the business cycle over a broad array of time. The core economic, market, and credit expansion signals still indicate an imminent correction in the foreseeable future.

Economic Signals

Economic Insights

The fourth quarter in 2018 and the first quarter of 2019 illustrated an overall slowdown of the economy. The Federal Reserve remained neutral with no changes to the Fed Fund rate and even signaled a potential rate cut in 2019. This behavior by the Fed has kept the economy in a neutral position but with much greater volatility than prior years. Since October 2018, the VIX has experienced higher volatility, the markets remain insecure about the future of the economy.

July officially marks the longest recovery/expansion in US history which should give any student of the economy pause about how much longer the political rhetoric and rate tinkering by the Federal Reserve can keep the economy going. Regardless of the ensuing recessions timing, the primary issue remains the same, interest rates are historically low this late in an expansion. On average, the Federal Reserve has decreased the Fed Funds rate by 7.18% at the start of a recession and the lowest rate on record going into a recession was 5.26% in 2008. With the Federal Reserve signaling a rate decrease this indicates we are at the start of the rate decline and with the Fed Fund rate at 2.5% the Federal Reserve has only one third of the average rate (7.16%) decline from past recessions to work with before rates go into negative territory.

Another issue the Federal Reserve is juggling is their inability to keep their newest tool, interest paid on reserves (IOER), in alignment with the market interest rate. LIBOR started to de-couple from the interest rate on reserves in March 2018. The significant demand for loans in the market increased the market interest rates and the Fed’s lag in the rate adjustment caused an exodus of reserves into the marketplace. As a result, the excess reserves banks keep at the Federal Reserve have declined significantly from their peak and now at a neutral position with demand deposits.

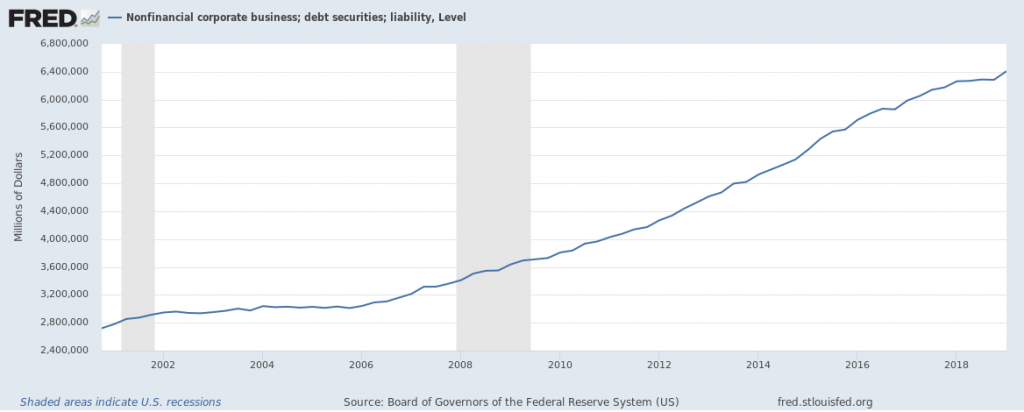

Even with a decrease in reserves the banking sector remains healthy and there has not been a significant credit expansion during this recovery. However, perpetually low rates have caused significant malinvestment in the marketplace by non-financial companies. These rates have driven non-financial corporate debt to an all time high at $6.5 Trillion with hundreds of zombie companies unable to pay their debt service at historically low rates with operating profits.

The Federal Reserve is in an impossible conundrum with ineffective tools and a bloated balance sheet. Thee most likely option is to continue to suppress interest rates through increasing their balance sheet, decreasing the fed fund rate, and increasing the interest rate on excess reserves (IOER). In a worst-case scenario if the economy start to decline and rate are ineffective, the Federal Reserve will decrease the excess reserve rate and encourage a credit expansion to get the economy going again. This will leave the banking sector in a weaker position and demand deposits fractionally covered.

The above will only prolong the inevitable and continue to misallocate resources via malinvestment. The next significant correction will not be banking or housing, it will be corporate America. The Federal Reserve’s artificially low interest rate policies continue to create a perpetual series of asset bubbles. Economic signals remain the same as the 2nd quarter report and cautious risk management is recommended until the next stage of the business cycle occurs.